Rethinking home ownership: The impact of Rentvesting

by Alex Harvey

Introduction

The Australian Institute of Health and Welfare (AIHW) recently published a report on trends in home ownership, using data from the 2021 Census. Their report notes a decline in home ownership rates, from 70% in 2006 to 67% in 2021. It is clear that this finding has substantial implications for public policy debates, particularly around housing affordability, tax incentives such as negative gearing and the capital gains tax (CGT) discount, and government intervention in the property market.

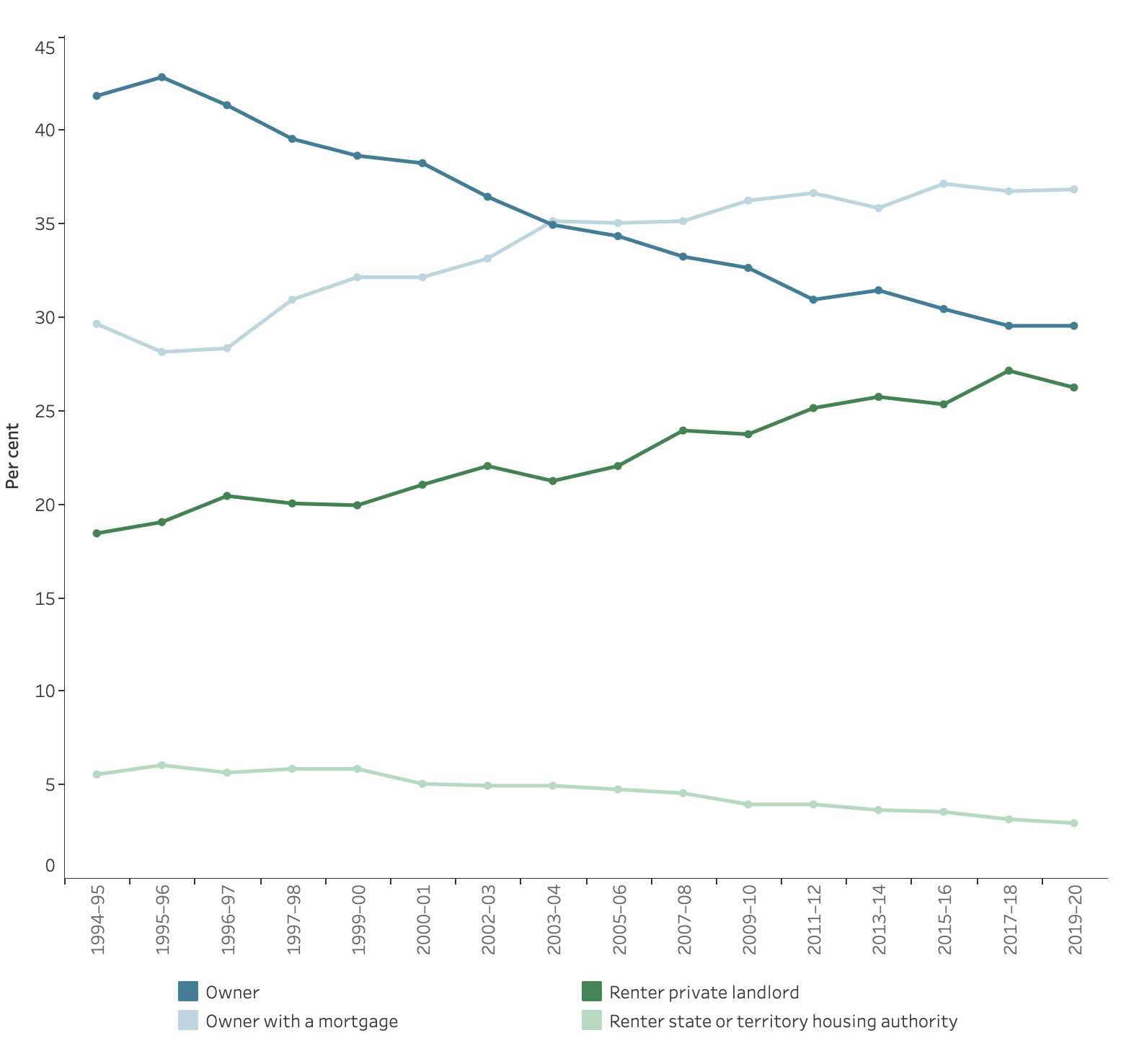

The chart below from the ABS shows a 4% decline in home ownership over 2 decades, accompanied by an increase in both renting and properties under mortgage.

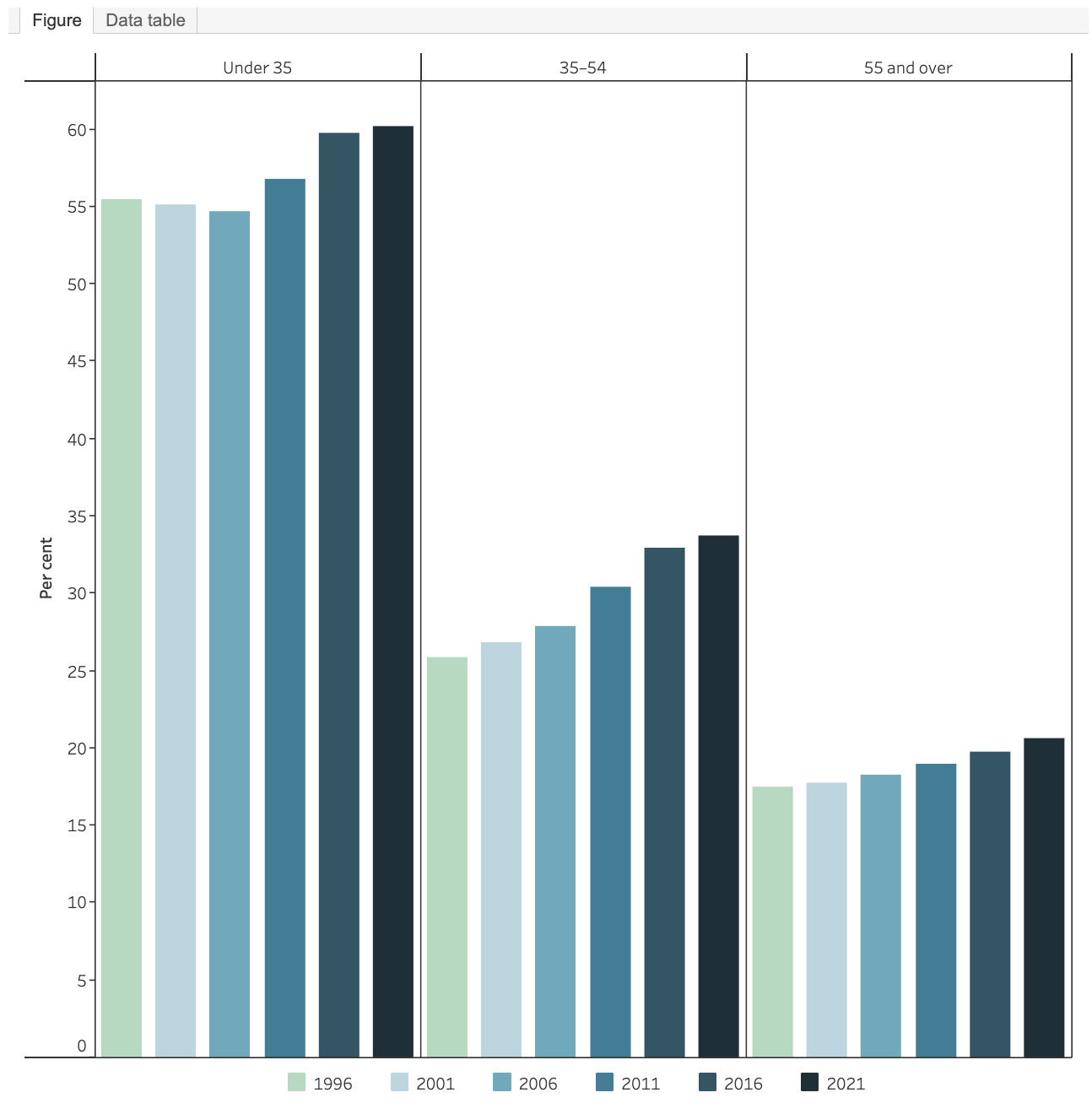

More concerning is the variation across age groups, as seen in the age-stratified data breakdown:

However, a significant oversight exists in this AIHW analysis: it fails to account for the portion of renters who are ‘rentvestors’, i.e., individuals who invest in property while renting elsewhere.

Rentvestors

According to ABS data published in 2023, about 15% of renters nowadays are rentvestors.

One way to correct for the effect of rentvestors on home ownership rates is to simply reclassify them as owners. The Australian housing breakdown, according to the AIHW data, is as follows:

- Owner-occupiers: 67% of households

- Renters: 33% of households

- Private renters: 26% of households

- Public renters: 7% of households

Assuming that all rentvestors are private renters, we can focus our adjustment solely within that group. With 15% of private renters identified as rentvestors, these rentvestors would be reclassified as owners. Thus, the adjustment is calculated as follows: 15% × 33% of households = 4.95%, approximately 5%.

- Adjusted owners: 67% + 5% ≈ 72%

- Adjusted renters: 33% - 5% ≈ 28%

So, correcting for these 15% of renters reveals that the home ownership rate in 2021 is actually still the same as it was in 2006, or around 72%. This suggests that there has not been any decline in the home ownership rate at all.

Note that I have assumed here that rentvesting did not exist in 2006, although it surely did — even if it was an unnamed and rarer phenomenon. By way of a simple sensitivity test, I would note that an assumption of a 5% rentvestor rate in 2006 would require the home ownership rate in 2006 to be adjusted from 70% to 71.3%. My conclusion of no change in the home ownership rate since 2006 would remain unaffected.

Implications for policy

The adjustment in home ownership rates refutes the narrative that investor-friendly tax concessions have caused a decline in ownership (e.g.). With ownership rates unchanged at approximately 72%, it becomes clearer that other factors have played a bigger role in causing the housing affordability crisis. These include Covid-era inflation, shutdowns of construction, shortages of labourers and tradespeople, and a post-Covid surge in immigration.

Note that rentvestors tend to be younger Australians who use this strategy to enter the property market despite high prices. This helps explain the lower direct ownership rates in age-stratified data, as many younger buyers opt to rent in preferred locations while investing elsewhere. Reclassifying rentvestors reveals that younger age groups are more active in property ownership than the data initially suggest.

This revision does not lessen the need for affordability measures or deny that skyrocketing property prices pose a major societal challenge. We do need to make houses cheaper.

But with no expected benefits from changes to investor tax incentives, the potential drawbacks need to be carefully considered. Changes to negative gearing could prompt investors to prioritise maximising rental return while cutting back on spending on repairs and maintenance. Additionally, investors may shift to seeking out positively-geared properties — low-cost properties with high rental yields — limiting tenant options and concentrating renters in less desirable housing.

More concerningly, removing negative gearing may undermine the rentvesting strategy that 15% of renters have used to enter the property market. This would, in fact, restrict pathways to home ownership, and make it even harder to get a foothold on the property ladder.

Changes to the CGT discount, meanwhile, could make investors more reluctant to sell, further restricting supply of properties available for purchase.

Conclusion

The AIHW’s report, when corrected for rentvestors, reveals a stable home ownership rate of 72%, undermining the claim of a significant decline since 2006. This adjustment not only affects public perception but also shifts the basis for policy decisions. Put simply, tax incentives for property investors have not contributed to declining ownership rates, contrary to what is often assumed.

Policymakers need to incorporate this corrected view of home ownership into decision-making. Housing affordability remains the defining economic issue of our time, and it can only be addressed by increasing the supply of both rental properties and new dwellings. Investors have a crucial role to play in achieving these objectives, making it essential to find policies that balance the needs of both aspiring homeowners and the broader housing market.

References

- https://www.abs.gov.au/statistics/detailed-methodology-information/information-papers/new-insights-rental-market

- https://www.aihw.gov.au/reports/australias-welfare/home-ownership-and-housing-tenure

- https://www.abs.gov.au/statistics/people/housing/housing-occupancy-and-costs/2019-20#housing-tenure